There are more than 500 miles that separate the western, more mountainous region of North Carolina from the U.S. state’s eastern shorelines. It’s an expansive area that, depending on traffic, can take close to 9 hours to drive. The popular phrase "from Murphy to Manteo" (or "from Manteo to Murphy," depending on who you ask) captures a phenomenon that touches all regions of the state, with references to one of the most westernmost and easternmost points.

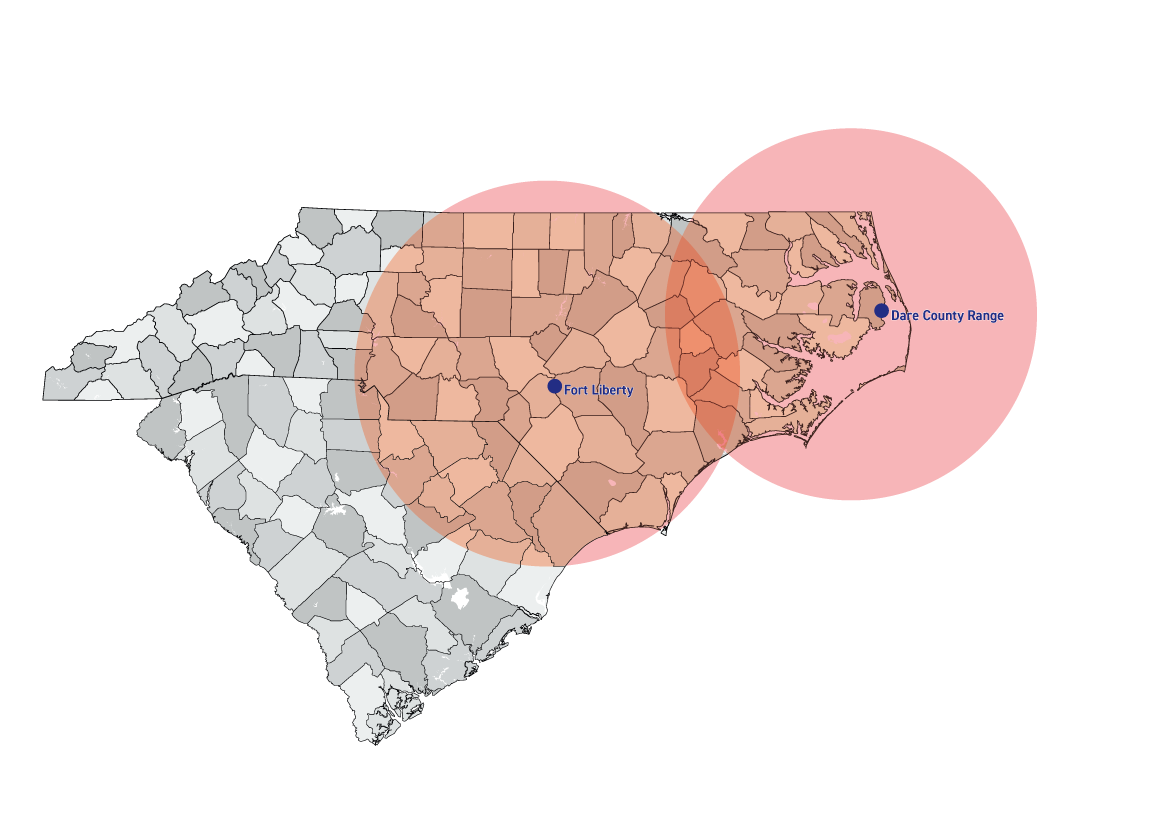

Despite the large land mass, investors from overseas looking to purchase or lease real estate in this fast-growing region of the country need to pay close attention to federal rules that review such transactions. That’s because the presence of two military installations may trigger government reviews for foreign investors involved in real estate deals if the transaction falls within a 100-mile radius of either site. Put another way: approximately three-quarters of North Carolina along with a portion of South Carolina fall into this federal review process. While not quite as expansive as Murphy to Manteo, this covered area does stretch from the town of Mooresville, in the Piedmont region near Charlotte, to the coastal town of Manteo. Any foreign real estate investors in North Carolina should keep this in mind if their site falls anywhere between these two towns.

Reviews by the Committee on Foreign Investment in the United States (CFIUS) are aimed at addressing national security and an expansion in the past few years means more scrutiny is placed on real estate transactions by foreign investors in states such as South Carolina and Georgia. CFIUS filings can add time and money to the front end of a transaction, so it is critical foreign investors are aware of how a review is triggered, what the implications are of not filing a report, and what exceptions exist regarding real estate transactions. While this alert is focused on the Carolinas given the large amount of land that is covered by CFIUS regulations, foreign real estate investors across the U.S. must pay close attention to CFIUS as most states have at least one military installation that can trigger review, and the number of such installations is likely to increase with newly proposed rules.

Background on CFIUS Reviews

Originally established by executive order in 1975, CFIUS is an interagency federal body chaired by the Department of Treasury that is tasked with reviewing the national security implications of investments by foreign persons in the United States. Prior to 2018, CFIUS’ review was limited to transactions where a foreign person would gain control of an existing U.S. business. Because of this, greenfield projects or pure-play real estate transactions made by foreign persons were generally not subject to CFIUS review, provided no existing U.S. business was acquired (i.e., no employees or assets were acquired).

In August 2018, however, Congress passed the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), which, among other things, expanded CFIUS’ authority to review not just transactions where a foreign person might gain control of an existing U.S. business, but also minority investments that are non-passive and give foreign investors certain rights. The expansion also included pure-play real estate transactions that do not involve an existing U.S. business, which is known as a "covered real estate transaction" under CFIUS.

Covered Real Estate Transactions and Impacted Areas in the Carolinas

Despite the fact the FIRRMA was passed in 2018 and the final regulations governing covered real estate transactions became effective in February of 2020, we have found that many involved in foreign direct investment (FDI) still view CFIUS as an issue for just mergers and acquisitions and do not consider whether their project may be a covered real estate transaction. This mistake can have severe consequences, as getting a covered real estate transaction approved by CFIUS provides a safe harbor for future review, while CFIUS can review, in perpetuity, those transactions for which a filing was not made (a so-called "non-notified transaction").

If CFIUS determines that a non-notified transaction poses a threat to U.S. national security, it can impose costly mitigation measures, and even require divestment in the most extreme cases.

Under existing CFIUS regulations, a transaction will be a covered real estate transaction if a foreign person purchases, leases or is otherwise granted a concession in "covered real estate." Such transaction must give the foreign person at least three of the following four property rights:

- Physical access to the real estate.

- The ability to exclude others from physically accessing the real estate.

- The right to improve or develop the real estate.

- The right to attach fixed structures or objects to the real estate.

It is important to note that because the definition is so broad, land purchases and leases as well as other concessions (such as a license) can trigger CFIUS review.

In addition to other categories of real estate, which are beyond the scope of this client alert, covered real estate is defined as land that is within a 1-mile radius of certain U.S. military installations, as well as real estate located within a 100-mile radius of other installations, an extended range meant for more sensitive sites.

North Carolina and South Carolina have several military installations that can trigger CFIUS review for real estate within a 1-mile radius. What is notable about this region is the presence of Fort Liberty (formerly known as Fort Bragg), outside of Fayetteville, and Dare County Range, outside of Manns Harbor, NC.

Both are identified in the CFIUS regulations as installations that can trigger CFIUS review for real estate transactions within a 100-mile radius. Given this, the extended range from each of these installations means that roughly the eastern three-quarters of all of North Carolina, and the northeastern portion of South Carolina are covered real estate, as shown in the graphic below.

CFIUS rules have the potential to change in the near future. On July 8, 2024, the Treasury Department issued a notice of proposed rulemaking that would add more then 50 military installations across 30 states to the existing list of sites that are within CFIUS’ scope.

This latest update, according to Treasury, would vastly expand CFIUS’ real estate jurisdiction. In the Southeast, proposed sites that would be subject to the 100-mile extended range include Joint Base Charleston as well as Moody Air Force Base and Townsend Bombing Range, both in Georgia. The extended range of these new sites would cover much of the eastern and the southern parts of South Carolina and Georgia.

What Does This Mean for Foreign Real Estate Investors in the Carolinas and Beyond

While CFIUS has broad coverage over the Carolinas, it does not mean that all, or even many, of the foreign investors (whether a foreign national, or a legal entity ultimately owned by a foreign national or government, regardless of the jurisdiction of formation) considering a real estate transaction in this region or in other parts of the U.S. will need to make a filing with CFIUS.

That’s because there are several exceptions that exist that can take a real estate transaction out of CFIUS’ jurisdiction, even if it would otherwise be a covered real estate transaction. Certain transactions may be exempt based on the nature of the transaction, with exceptions existing for those involving:

- Single housing units.

- Real estate located in urban areas and urban clusters (as defined by the Census Bureau).

- Certain retail and commercial office space.

Additionally, investors who qualify as "excepted real estate investors" because they are from an "excepted real estate foreign state" may avoid CFIUS review. Currently, those countries are Australia, Canada, New Zealand, and the United Kingdom. However, these exceptions are complex and contain traps for the unwary, so real estate investors are advised to consult with experienced legal counsel to determine whether they can rely on this exception.

Finally, even if no exception exists, there are currently no mandatory filings for covered real estate transactions; rather, it is a voluntary process. Experienced legal counsel can help foreign real estate investors determine whether a voluntary filing is advisable, as this is based on a number of specific facts, including the country of origin of the foreign investor, with particular attention warranted for those from the Peoples’ Republic of China and other states that have been deemed countries of concern for U.S. national security, such as Russia and Iran. It is also based on the nature of the proposed business at the covered real estate.

Final Takeaway

Any foreign investor in the U.S. considering a project involving real estate would be wise to consult with legal counsel to determine whether a filing with CFIUS is prudent. This analysis should be done sooner, rather than later, as CFIUS filings can take weeks, or in some cases months, to be reviewed, adding the potential of impacting a project’s timeline.

Failing to build in enough time for CFIS review before the closing of a transaction or a public announcement can result in unexpected costs and public embarrassment if CFIUS blocks or unwinds the transaction or imposes mitigation measures that render the economics of the project unfeasible after it has been announced.

Our team of attorneys and consultants can not only help foreign investors identify the risks of CFIUS review early on, but can also lean on our decades of experience advising foreign companies doing business in the U.S. to develop a fulsome legal and site selection strategy that gets FDI projects accomplished as smoothly as possible.

For more information, please contact us or your regular Parker Poe contact. You can also subscribe to our latest alerts and insights here.